step three. Murabaha was a product where the financier acquisitions the house and you will sells it towards consumer with the an excellent deferred foundation at the an arranged-up on cash. The customer pays a deposit and you may repays new financier more a good period of time, as well as a profit costs with every payment. It is not a loan having attract – its a selling that have a beneficial deferred payment.

The final several activities has significant cons. From inside the Ijara, the house consumer is basically a tenant for the whole several months of your contract and does not benefit from the great things about homeownership until payment is complete. Meanwhile, Murabaha produces a duty toward household consumer you to definitely payday loan near me is comparable to loans. Very Diminishing Musharakah could have been deemed from the extremely extremely respected scholars when you look at the Islamic financing once the best choice, and is the latest method taken of the Advice Residential while the inception inside the 2002.

Towards Co-Control Model

Guidance Residential’s proprietary brand of Islamic a home loan are a questionnaire off Diminishing Musharaka entitled Declining Harmony Co-Ownership. Inside model, since the home visitors and Information Domestic agree to become co-owners of a particular possessions, both people purchase the home to each other. New % of the house belonging to both parties is decided because of the for each side’s investment. (Eg, should your domestic buyer pays 20% of your purchase price, that they have 20% of the house, and you will Recommendations possess 80%.) The home client upcoming produces monthly installments to Pointers Residential, increasing the show that they have up until he’s got purchased every one of Information Residential’s possession stake. Then household visitors becomes truly the only manager of the property.

Inside design, the house consumer advantages of purchasing and you can located in your house well before he has got complete to order Information Residential’s share regarding the property, so they spend Guidance a fee for playing with Guidance’s express out of the house

One benefit associated with model is that, since Co-People who own the house, Pointers Home-based shares the risks off home ownership to you. And you may charge try capped, free of the new invisible costs regarding a timeless financial.

An introduction to the fresh new Islamic Real estate Process

To get a house which have Islamic resource involves the exact same four steps one some other U.S. domestic buy need: app, control, underwriting and you may closing. The difference is the fact that contract is halal, or sharia-certified.

1. Degree or App

Step one should be to promote Advice Domestic with very first guidance in regards to you plus profit to be able to discover simply how much funding you could qualify for.

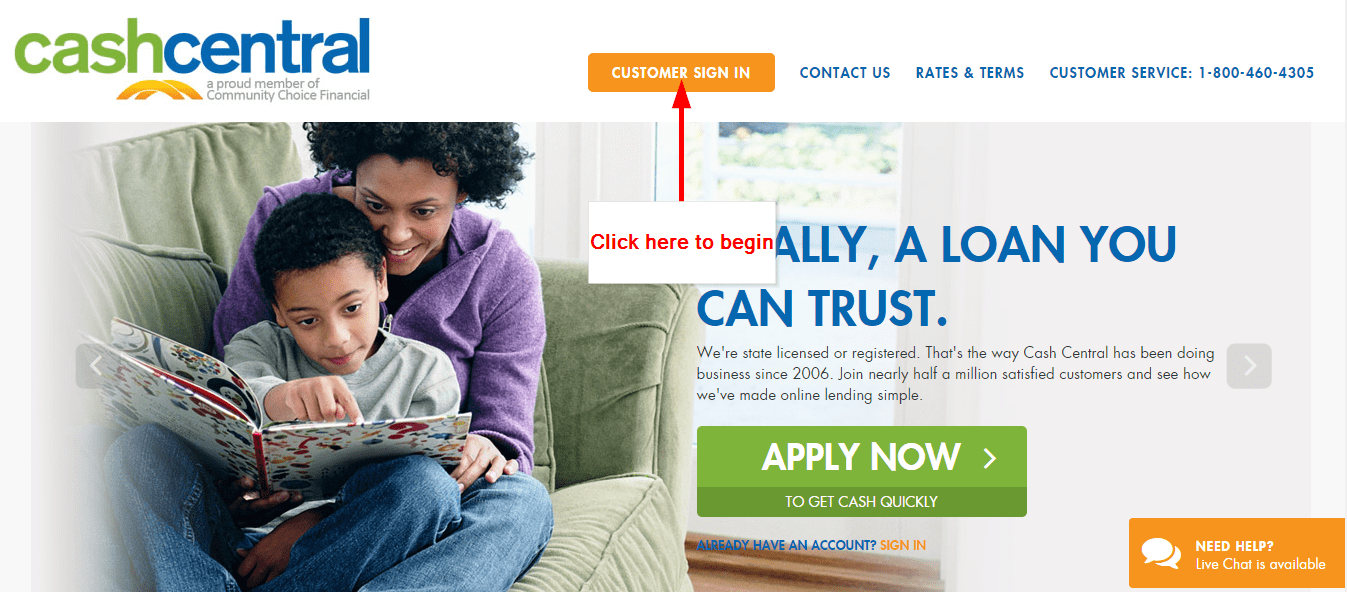

You can start that have a simple Pre-Degree early in your own trip if you would like to find a rough guess of the home speed you may be in a position to cover the. But you can and forget you to definitely optional action and you may move physically on Pre-Recognition App.

Once you fill out your own Pre-Approval software, you’ll fill in papers of data including money, employment and coupons. A good financier have a tendency to make certain your application and you may reveal what capital you are able to qualify for. Are Pre-Acknowledged ensures that you are prepared to genuinely look getting a house – Realtors will predict that getting Pre-Approved before they direct you homes. Pre-Approval is even the initial step if you prefer to help you refinance a property you currently own. Our on line app walks you from the procedure and helps it be very easy to done anytime you like.

When you make a deal towards the a house and your contract has been approved of the seller, make an effort to done the job to have financing that particular assets. If you have already been Pre-Recognized, a lot of the job are certain to get started complete.